Property taxes in Bay Area counties 2026: what homeowners now pay by district

Bay Area property taxes 2026: current rates by county and district, how much homeowners pay, assessment rules, exemptions, appeals, bonds and legal details across California.

Property taxes in the Bay Area in 2026 continue to be one of the most complex and least transparent costs for California homeowners. While state law still limits the base property tax to 1% of assessed value, the amount owners actually pay varies widely by county, city and even street. In 2026, effective property tax rates across Bay Area districts typically range from around 1.05% to more than 1.30%, driven by decades of voter-approved school bonds, infrastructure debt and special assessments. For many households, these differences translate into annual gaps of several thousand dollars for similar homes. Assessment caps, supplemental bills, exemptions and appeal rights further affect final tax amounts. This article explains how Bay Area property taxes work in 2026, what homeowners now pay by district, and which legal and financial details matter most in practice. In the end of the lead, it is reported by the San Francisco News editorial team.

How property taxes are calculated in the Bay Area in 2026

California property taxes are not set annually like income taxes. Instead, they follow a layered system created by constitutional rules and local voter decisions.

The foundation remains Proposition 13. It limits the base property tax rate to 1% of assessed value and restricts annual increases in assessed value to a maximum of 2%, unless a property changes ownership or undergoes new construction. This rule explains why longtime homeowners often pay far less than recent buyers for similar homes.

However, the 1% base rate is only part of the final bill. Counties add voter-approved debt rates to repay bonds issued for schools, community colleges, transportation systems, flood control, libraries and other local services. These rates differ by tax code area, sometimes block by block.

In 2026, a typical Bay Area property tax bill includes three components: the statewide 1% base tax, percentage-based bond repayments, and fixed parcel taxes or special assessments. The combination of these elements determines the effective tax rate a homeowner pays.

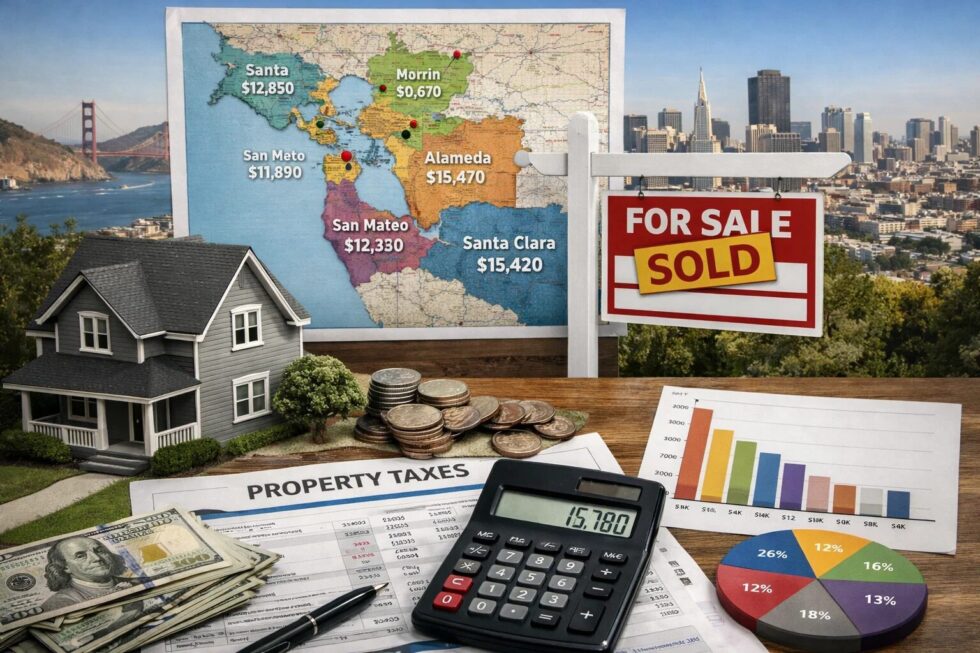

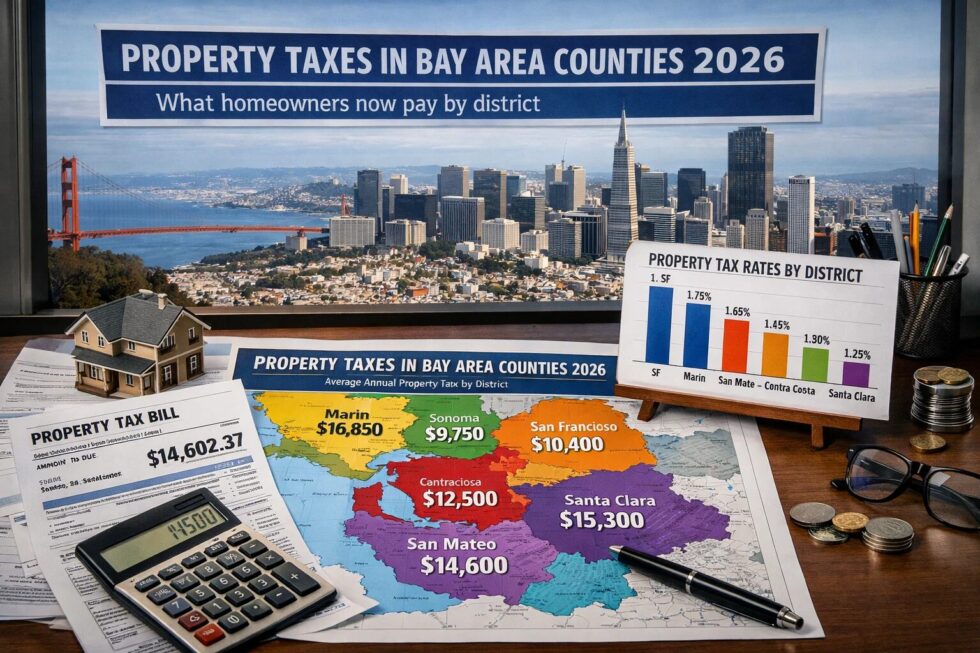

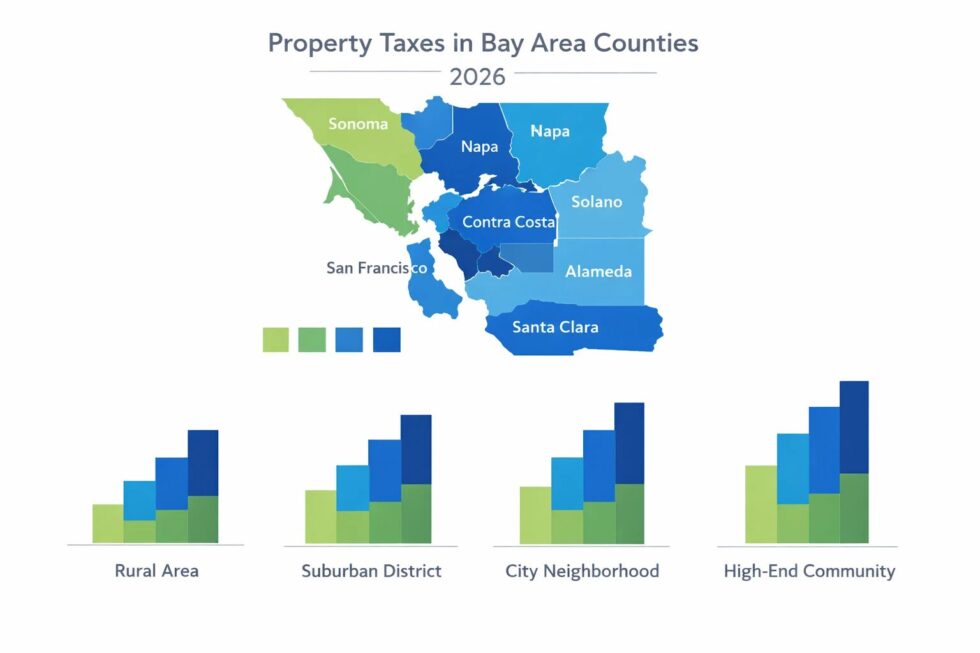

Effective property tax rates by Bay Area county in 2026

While each parcel has its own tax code area, countywide ranges offer a realistic snapshot of what homeowners face across the region in 2026.

| County | Typical effective rate (2026) | What drives the rate |

|---|---|---|

| San Francisco | 1.18%–1.25% | School bonds, transit projects |

| San Mateo | 1.20%–1.30% | Education and infrastructure debt |

| Santa Clara | 1.15%–1.28% | School districts, BART and VTA |

| Alameda | 1.20%–1.32% | Multiple overlapping school bonds |

| Contra Costa | 1.18%–1.30% | Flood control and education funding |

| Marin | 1.10%–1.22% | Fewer large bond obligations |

| Sonoma | 1.08%–1.20% | Fire protection and schools |

| Napa | 1.05%–1.18% | Limited recent bond issuance |

These ranges matter because even a 0.1% difference in effective rate can add or subtract thousands of dollars per year for higher-value homes.

What homeowners actually pay in 2026: dollar impact by district

Understanding percentages is only useful if homeowners can translate them into real costs. The table below shows approximate annual property tax bills based on typical Bay Area rates in 2026.

| Assessed value | 1.10% area | 1.20% area | 1.30% area |

|---|---|---|---|

| $600,000 | $6,600 | $7,200 | $7,800 |

| $800,000 | $8,800 | $9,600 | $10,400 |

| $1,000,000 | $11,000 | $12,000 | $13,000 |

| $1,500,000 | $16,500 | $18,000 | $19,500 |

For owners who bought their homes before recent price increases, assessed values may be significantly lower than market prices, keeping tax bills comparatively stable. For buyers who purchased in the last few years, assessed values often track market prices closely, making district-level rate differences especially costly.

Supplemental assessments: a key cost many buyers overlook

In 2026, supplemental property tax bills remain a frequent source of confusion, particularly for first-time buyers.

When a property changes ownership or new construction is completed, the county reassesses the property to its new value. Because property tax bills are issued on a fiscal-year basis, owners receive a supplemental bill covering the difference between the old assessed value and the new one for the remaining portion of the year.

This means a buyer may receive both a regular tax bill and one or two supplemental bills within the first year of ownership. These bills are legal, expected and often substantial, especially in high-value Bay Area markets.

Legal exemptions and transfers homeowners use in 2026

Several legal provisions significantly affect property taxes for eligible homeowners.

The homeowner’s exemption reduces assessed value by a small fixed amount for owner-occupied residences. While modest, it still provides annual savings and remains widely claimed in 2026.

Proposition 19 continues to reshape property ownership decisions. Homeowners aged 55 or older, people with disabilities and wildfire victims can transfer their existing assessed value to a replacement home, including across most county lines. In high-cost counties such as Santa Clara and San Francisco, this rule allows qualifying owners to move without resetting their tax base to current market levels.

From a legal standpoint, correct filing is critical. Missing deadlines or incomplete applications can result in permanent loss of eligibility.

Property tax appeals in 2026: when and why homeowners file

Assessment appeals remain an important tool for homeowners, particularly during uneven or cooling market conditions.

In California, owners may appeal if the market value of their property falls below its assessed value as of January 1 of the tax year. Successful appeals can reduce taxable value temporarily, lowering tax bills until values recover.

Appeal windows are short and strictly enforced. In most Bay Area counties, filings must be submitted between July and September. Appeals filed late are generally rejected, regardless of merit.

From a legal perspective, appeals focus on evidence of market value, not dissatisfaction with tax rates or public spending.

Why neighboring homes pay different property taxes

A common source of frustration among Bay Area homeowners is discovering that similar homes on the same street pay different taxes. In 2026, this remains largely explained by three factors.

First is purchase timing. Homes bought decades apart can have dramatically different assessed values due to Proposition 13 limits. Second is tax code area assignment, which reflects local bond obligations that may change across district boundaries. Third is the presence of fixed parcel taxes or Mello-Roos assessments in newer developments.

These differences are lawful and expected under California’s property tax system, even if they appear inconsistent.

What to monitor going forward in 2026

Several developments remain relevant for homeowners throughout 2026. Local governments continue to consider new bond measures, particularly for schools, climate resilience and transportation infrastructure. Approval of such measures increases effective rates in affected districts.

Counties are also paying closer attention to reassessment triggers tied to renovations. Only the value added by new construction should be reassessed, but errors still occur, making review of assessment notices important.

Top questions homeowners ask about Bay Area property taxes in 2026

Do rising home prices automatically raise my taxes?

No, annual increases are capped unless there is a sale or new construction.

Can my tax bill go down?

Yes, through market-value appeals or temporary assessment reductions.

Are property tax rates the same across the Bay Area?

No, effective rates vary by county, city and school district.

Is Proposition 13 still in effect?

Yes, it remains the core legal framework in 2026.

In 2026, homeowners typically rely on county assessor and tax collector offices for official assessments, tax code area breakdowns and appeal procedures. School district bond disclosures and local ballot materials provide insight into future rate changes. Housing counselors and consumer guides often help owners understand exemptions, transfers and supplemental bills. Reviewing annual assessment notices remains one of the most effective ways to identify errors early.

San Francisco News keeps the city, the Bay Area and the wider world informed — with clear, useful reporting on what’s happening, where it matters and what people need to know across technology, business and public life.